Marshfield SCHOOL TAX LEVY DISBURSEMENT

December 2025

Although the School District of Marshfield’s total school tax levy declined by nearly 1% in 2025, the change will affect property owners differently depending on where they live. The school district includes 13 separate municipal units, and school taxes are allocated among them based on changes in property values.

Public school funding in Wisconsin relies in part on the state’s Equalization Aid Formula, which uses each municipality’s Equalized Valuation—essentially its fair market property value as determined annually by the Wisconsin Department of Revenue. When property values rise faster in one municipality than in others, that area assumes a larger share of the school district’s tax levy.

In 2025, property value growth varied significantly across the district. Municipalities such as the Town of Richfield and the Town of Fremont experienced sharp increases in equalized property values. As a result, property owners in those areas will see an increase in the school district portion of their property tax bills.

By contrast, property values rose more modestly in the City of Marshfield and the Town of McMillan. Because their share of the district’s total equalized value declined, property owners in those municipalities will see a decrease in the school district portion of their 2025 property tax bills.

In short, even with a lower overall levy, school taxes shift between municipalities based on relative changes in property values, rather than changes in district spending.

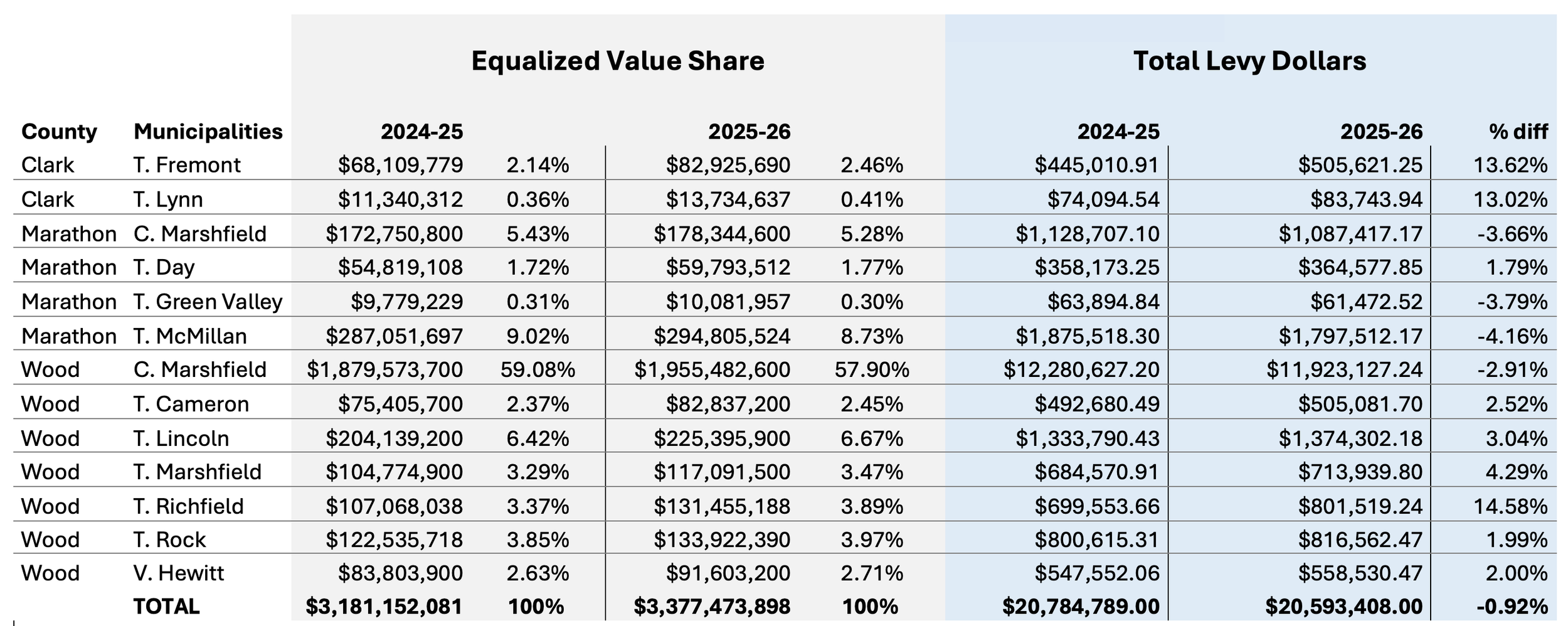

The table below illustrates year-over-year changes in Equalized Value and the resulting school tax levy for each municipality within the School District of Marshfield.

School Board Approves Lower Tax Levy for 2025–26

November 2025

The School District of Marshfield Board of Education has approved a reduced school tax levy for the 2025–26 fiscal year, reflecting a nearly 1% decrease from the previous year. At its October 22 meeting, the Board unanimously set the total levy at $20,593,408, with a mill rate of $6.10—down from $20,784,789 and a mill rate of $6.53 in 2024–25.

This decrease follows the successful $71.5 million facility referendum passed in November 2024, which supports critical upgrades across the district. The referendum prioritizes improvements in safety and security, student learning spaces, and aging infrastructure, based on a comprehensive facility study that included input from staff, students, and community members.

As projected, the district received a significant boost in state aid—nearly $3 million more for 2025–26—helping offset the costs of the new bond levy for facility improvements. The increased aid allowed the district to reduce its operational levy, offsetting the bond levy and resulting in an overall decrease. This approach aligns with the district’s long-term goal of maintaining levy stability and minimizing fluctuations in the school portion of property tax bills for local residents.

After a year of increased taxes due to reduced equalization aid and school levy tax credits—largely stemming from the absence of a debt levy in 2023—the district anticipates more consistent funding moving forward. With the new debt structure in place, future levies are expected to remain steady, offering taxpayers greater predictability while enabling continued investment in essential school upgrades.